Fiction: Massachusetts can only be an R&D hub for life science companies.

Fact: Massachusetts is the global hub for research and development in the life sciences and also represents an amazing opportunity for manufacturing.

A wide range of companies choose to co-locate their R&D and their manufacturing operations to leverage their investments in each and benefit from the incredible ecosystem of talent here in the Commonwealth. Moderna, Ultragenyx, Alnylam, Sanofi, Takeda, and other world leaders, have all understood the value of connecting their R&D and manufacturing facilities and talent base.

According to our partners at MassBio, Massachusetts continues to grow as a biomanufacturing destination, largely outside urban settings. We also have strong positioning to lead in the cell and gene therapy and personalized medicine sectors, which specifically require manufacturing in close geographic proximity to research and development.

MassBio offers important resources for companies considering locating in Massachusetts by evaluating communities across the Commonwealth who are BioReady. From biotech-zoned science parks to streamlined permitting, to robust infrastructure, and pre-permitted biotech sites, Massachusetts has it all for companies looking to relocate.

Because of the state’s rich history in biotechnology, many of its cities and towns have increasingly adopted local policies that greatly ease the pathway for renovation or new construction of biotech laboratory and manufacturing facilities. After identifying some community options in Massachusetts, companies can work with MassEcon to evaluate their needs and current available properties that meet the appropriate specifications.

MassBio’s recent reporting also points to our Commonwealth continuing to establish itself in biomanufacturing on the workforce front. Both Suffolk County (+29.1 percent) and Worcester County (+18.4 percent) saw significant growth in manufacturing jobs.

State | 2021 | 2022 | % Change |

|---|---|---|---|

Florida | 10,220 | 11,103 | 8.0% |

Massachusetts | 9,831 | 10,493 | 6.3% |

New Jersey | 26,447 | 28,068 | 5.8% |

Maryland | 10,506 | 11,012 | 4.6% |

Pennsylvania | 20,088 | 20,770 | 3.3% |

North Carolina | 24,286 | 24,733 | 1.8% |

New York | 24,615 | 24,406 | -0.9% |

Texas | 14,321 | 14,079 | -1.7% |

California | 51,693 | 47,141 | -9.7% |

The MLSC’s Pathmaker program supports organizations that can build and scale career pathways that effectively prepare students for high-demand career opportunities in the life sciences. Applicants must have at least one industry partnership that ensures that the program responds to a direct hiring need. As companies find the next innovation to transform patient lives, the MLSC and its partners are committed to ensuring our industry can find the talent needed to move their missions forward.

Region | Employees |

|---|---|

Greater Boston | 40,433 |

Minneapolis-St. Paul | 32,074 |

SF Bay Area | 29.173 |

Orange County | 28,953 |

Salt Lake City | 10,376 |

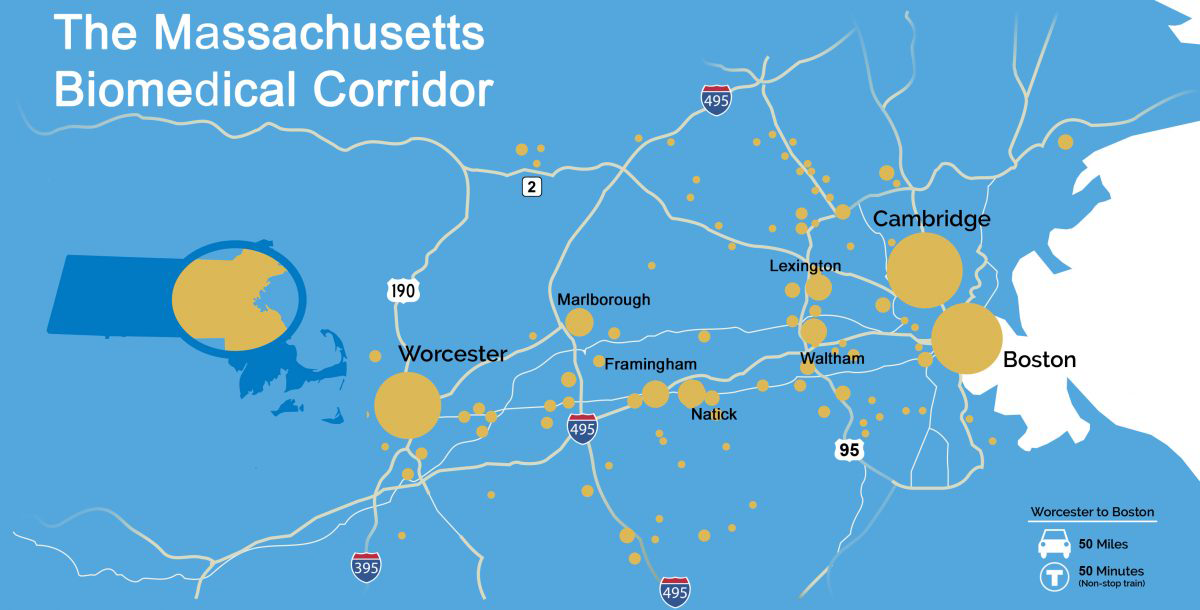

The density of the Massachusetts life sciences cluster is characterized by the concentration of research institutions, biotechnology/pharmaceutical companies, healthcare organizations, and technology/life sciences startups within the state. This dense cluster expands beyond Boston Cambridge and a key contributing factor is that most clusters are only 50 miles away from Boston/Cambridge.

Olaris is a precision diagnostics company that is on a mission to revolutionize how diseases are diagnosed and treated. By leveraging their CEREBRO platform (Comprehensive Early Responsive Evaluation of Biomarkers Related to Outcomes), which combines metabolomics and machine learning, they are able to harness the power of the body’s own communication system to discover and develop their pipeline of myOLARIS precision diagnostics.